UNITED STATES

|

|

|

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o | ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

Check the appropriate box: | ||||||||||||||||||||||||||||||

| o | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to Rule §240.14a-12 |

J & J SNACK FOODS CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| J & J SNACK FOODS CORP. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| No fee | |

| o | Fee paid previously with preliminary materials | |

| Fee computed on table | |

|

| |

|

| |

|

| |

|

| |

|

| |

| ||

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

350 Fellowship Road, Mount Laurel, NJ 08054

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

February 14, 202310, 2021

TO OUR SHAREHOLDERS:

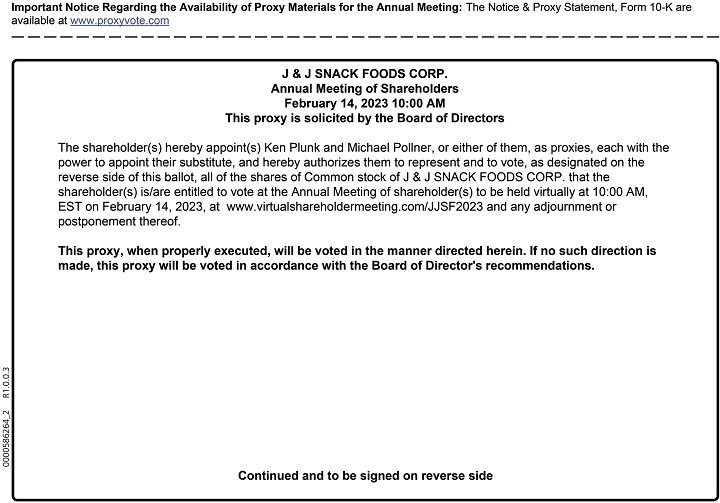

The annualWe are pleased to invite you to the 2023 Annual Meeting of Shareholders (the “Annual Meeting”) of J & J SNACK FOODS CORP. (“J & J”, the “Company,” “our,” “us” or “we”), which will be held virtually on Wednesday,Tuesday, February 10, 202114, 2023, at 10:00 A.M., E.S.T.Eastern Time., for the following purpose:

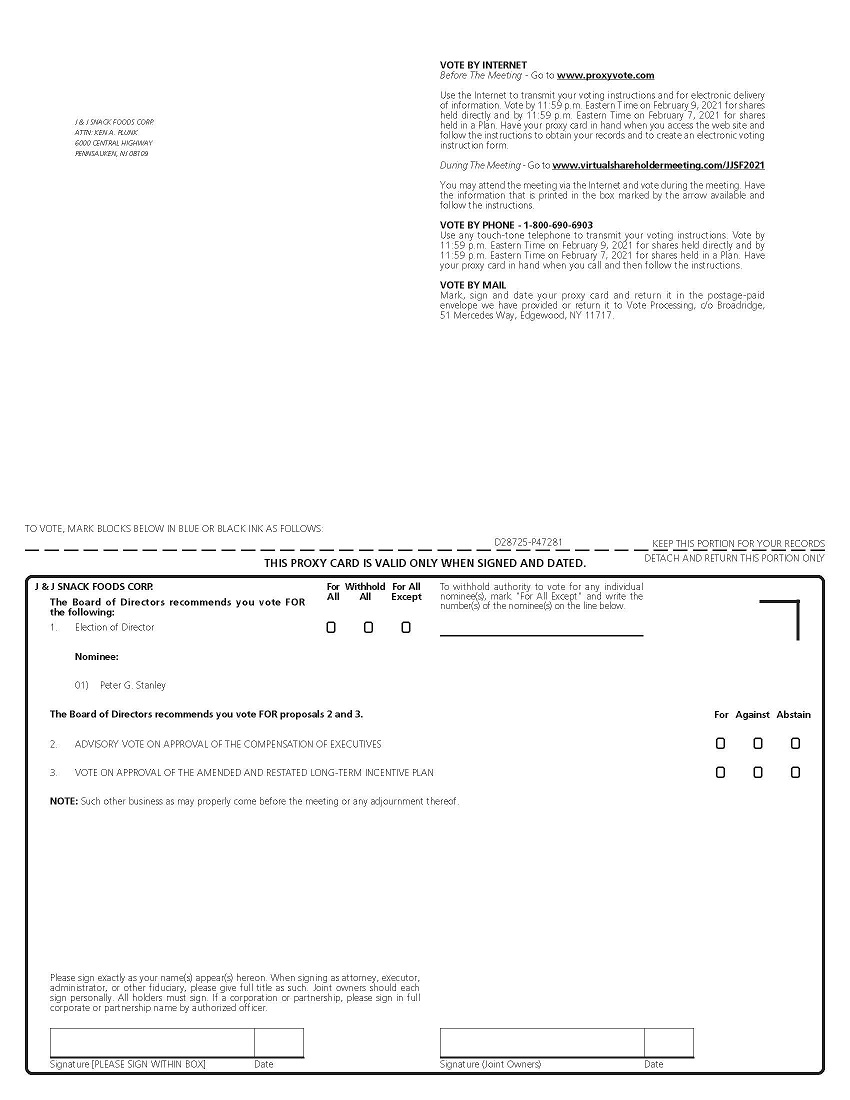

1. To elect one director;

Sidney R. Brown and Roy C. Jackson to serve as directors, each for a term ending at the 2028 Annual Meeting of Shareholders;

2. To approve the J & J Snack Foods Corp. 2022 Long-Term Incentive Plan;

3. To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2023;

4. To have an advisory vote on the approval of compensation of the Company’s named executive officers;

3.5. To approvehave an advisory vote on the J & J Snack Foods Corp. Amended and Restated Long-Term Incentive Plan (which amends and revisesfrequency of future advisory votes on the compensation of the Company’s 2017 Stock Option Plan);named executive officers; and

4.6. To consider and act upon such other matters as may properly come before the meeting and any adjournments thereof.

The Board of Directors has fixed December 14, 202019, 2022, as the record date for the determination of shareholders entitled to vote at the Annual Meeting. Only shareholders of record at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting.

Due to the public health impact of the COVID-19 pandemic and to support the health and well-being of our employees and shareholders, weWe are pleased to provide shareholders with the opportunity to participate in the Annual Meeting online via the Internet in a virtual-only meeting format to facilitate shareholder attendance and provide a consistent experience to all shareholders regardless of location. We will provide a live webcast of the Annual Meeting at www.virtualshareholdermeeting.com/JJSF2021JJSF2023, where you will also be able to submit questions and vote online. You will not be able to attend the meeting at a physical location.

Closed captioning will be provided for the virtual meeting.

YOU ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING ONLINE. WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING YOU ARE URGED TO SIGN, DATE AND PROMPTLY RETURN THE ENCLOSED PROXY. A SELF-ADDRESSED, STAMPED ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES.

By Order of the Board of Directors, | |||

| |||

| |||

| |||

December 21, 2020

TABLE OF CONTENTS

| ||

| Michael A. Pollner | ||

| Senior Vice President, General Counsel | ||

| and Secretary | ||

Important Notice Regarding the Availability of Proxy Materials for the Annual

Meeting of Shareholders to be Held on February 14, 2023:

Our Proxy Statement and 2022 Annual Report are available on our Investor Relations website (www.jjsnack.com/investors/) and at www.proxyvote.com. You may also request paper copies of these proxy materials free of charge by following the instructions for requesting such materials contained in the Notice of Internet Availability of Proxy Materials.

Page

General Information

| Meeting Date | Time | Location | Record Date |

| Live webcast at www.virtualshareholdermeeting.com/JJSF2023 | December 19, 2022 |

Voting Matters and Vote Recommendations

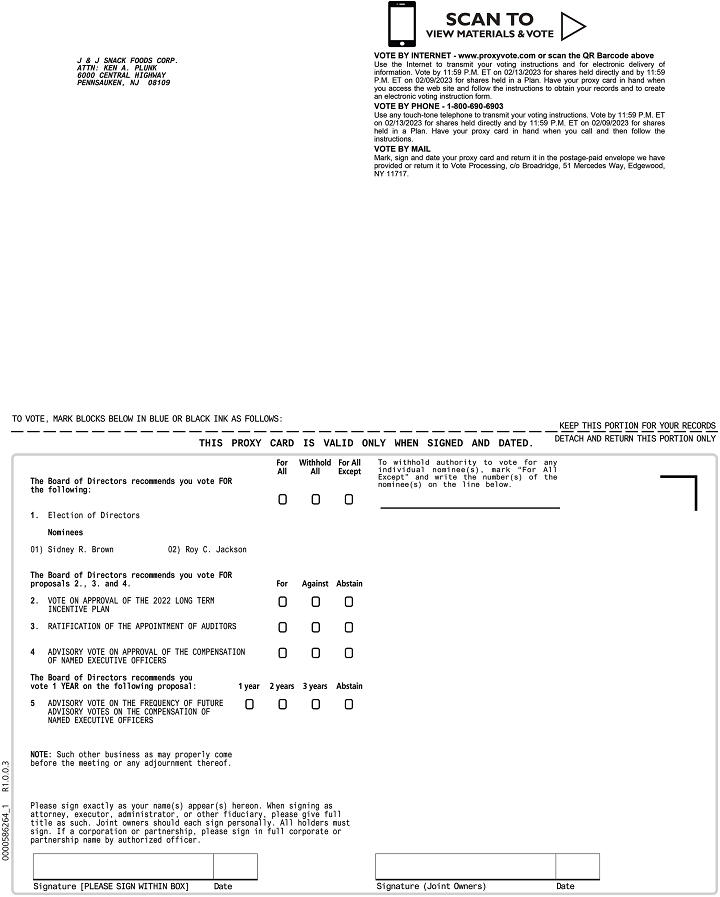

| Proposal | Matter | Board Vote Recommendation |

| “FOR” the election of each of the director nominees | ||

| 2 | Approval of the J & J Snack Foods Corp. 2022 Long-Term Incentive Plan | “FOR” the approval of the Plan |

| 3 | To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2023 | “FOR” the ratification of Grant Thornton LLP as our independent registered public accounting firm for fiscal year 2023 |

| 4 | Approval, on a non-binding advisory basis, of the compensation of our Named Executive Officers | “FOR” the non-binding advisory resolution approving our executive compensation |

| 5 | Non-binding advisory vote on the frequency of the advisory vote on the compensation of our Named Executive Officers | “ONE YEAR” as the frequency of the advisory vote on executive compensation |

Additional Information

| Admission to the Annual Meeting | ● Admission to the Annual Meeting is restricted to shareholders and/or their designated representatives. |

| Proxy Materials | ● On or about January 3, 2023, a Notice of Internet Availability of Proxy Materials (the “Notice”) was mailed to our shareholders of record as of December 19, 2022. ● The proxy statement, the proxy or voting instruction card, and our 2022 Annual Report to Shareholders are available at www.proxyvote.com. ● All shareholders may choose to access these materials electronically or may request printed or emailed copies at no charge. |

| 1 |

| How to Vote | It is important that your shares be represented and voted. ● Shareholders who received the Notice may vote their shares electronically at www.proxyvote.com, by telephone, or by mail after requesting a paper copy of the proxy materials. There is no charge for requesting a paper or email copy. ● We have also mailed paper copies of the proxy materials, including the proxy card, to some of our beneficial shareholders. These shareholders may also view the proxy materials online at www.proxyvote.com. They may vote their shares by mail, telephone, or Internet. To vote by mail, these shareholders should simply complete, sign, and date the proxy card and return it in the envelope provided. To vote by telephone or Internet, 24 hours a day, 7 days a week, these shareholders should refer to the proxy card for voting instructions. ● If you attend the Annual Meeting and want to vote at the Annual Meeting, you can withdraw your proxy. If your shares are held in the name of a broker, bank or other holder of record, you will need a control number and legal proxy from the holder of record in order to vote your shares. Please see the procedures described under “How can I participate in the Annual Meeting” on page 3 of the proxy statement. ● Please note the voting procedures described under “How do I Vote my shares?” on page 5 of the proxy statement. |

| Voting | ● Proposal 1 – you may vote “FOR” or “WITHHOLD”. ● Proposal 2 – you may vote “FOR”, “AGAINST,” or “ABSTAIN” from voting. ● Proposal 3 – you may vote “FOR”, “AGAINST,” or “ABSTAIN” from voting. ● Proposal 4 – you may vote “FOR”, “AGAINST,” or “ABSTAIN” from voting. ● Proposal 5 – you may vote “ONE YEAR”, “TWO YEAR,” “THREE YEAR” or “ABSTAIN” from voting. If you elect to “ABSTAIN” from voting on Proposal 2, Proposal 3, Proposal 4 or Proposal 5, your abstention will have no effect. In addition, a failure to vote on Proposal 1 will have no effect, subject to the application of our Director Resignation Policy discussed below. |

| 2 |

FREQUENTLY ASKED QUESTIONS ABOUT THE ANNUAL MEETING

AND VOTING

Why did you send me thisthese proxy statement?materials?

As permitted by the U.S. Securities and Exchange Commission (“SEC”) rules, we are making the proxy materials available to our stockholders primarily via the Internet. By doing so, we can reduce the printing and delivery costs and the environmental impact of the Annual Meeting. On or about January 3, 2023, we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders. The Notice contains instructions on how to access our proxy materials and how to vote online or by telephone. If you would like to receive a paper copy of the proxy materials, please follow the instructions in the Notice.

We sent this proxy statement and the enclosed proxy card to you because our Board of Directors is soliciting your proxy to vote at the virtual 2021 Annual Meeting of Shareholders (the “Annual Meeting”).Meeting. This proxy statement summarizes information concerning the matters to be presented at the meeting and related information that will help you make an informed vote at the meeting. This proxy statement and the accompanying proxy card are first being mailed to shareholders on or about December 21, 2020.

When is the Annual Meeting?

Annual Meeting?

The Annual Meeting will be held on Wednesday,Tuesday, February 10, 2021.14, 2023, at 10:00 A.M., Eastern Time. The Annual Meeting will be held via a live webcast, and there will not be a physical meeting location.

How can I participate in the Annual Meeting?

You will be able to attend the annual meetingAnnual Meeting online and to vote your shares electronically on the virtual meeting platform by visiting www.virtualshareholdermeeting.com/JJSF2021JJSF2023 and entering the 16-digit control number included on your proxy card or in the instructions that accompanied your proxy materials. This year the change is due to the global COVID-19 pandemic and issues related to social distancing and limits on mass in-person gatherings.

We encourage you to access the Annual Meeting before it begins. Online check-in will start approximately 15 minutes before the Annual Meeting on February 10, 2021.14, 2023. If you have difficulty accessing the meeting, please call the technical support number that will be posted on the Annual Meeting login page. We will have technicians available to assist you.

What am I voting on?

At the Annual Meeting, you will be voting:

|

|

● | To elect Sidney R. Brown and Roy C. Jackson to serve as directors, each for a term ending at the 2028 Annual Meeting of Shareholders; | |

| ● | To approve the Company’s 2022 Long-Term Incentive Plan; | |

| ● | To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2023; | |

| ● | On an advisory vote on approval of |

● | On an advisory vote concerning the frequency of future advisory votes regarding the approval of |

● |

|

| 3 |

How do you recommend that I vote on these items?

The Board of Directors recommends that you vote:

|

|

● |

| |

| ● | FOR approval of the Company’s 2022 Long-Term Incentive Plan. | |

| ● | FOR ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2023. | |

| ● | FOR the advisory vote approving executive compensation. |

● |

|

Who is entitled to vote?

You may vote if you owned our common share(s) as of the close of business on December 14, 2020,19, 2022, the record date for the annual meeting. On the record date, there were 18,955,73019,229,330 shares of J & J common stock, no par value (“Common Stock”) outstanding. Holders of our Common Stock at the close of business on December 19, 2022 are generally entitled to one vote per share of Common Stock outstanding.

on each matter to be voted upon at the Annual Meeting.

Who pays expenses related to the proxy solicitation?

The expenses of the proxy solicitation will be borne by J & J Snack Foods Corp. (“J & J”, the “Company” or the “Corporation”).Company. In addition to solicitation by mail, proxies may be solicited in person or by telephone by directors, officers or employees of J & Jthe Company and its subsidiaries without additional compensation. J & JThe Company may engage the services of a proxy-soliciting firm. J & J isWe are required to pay the reasonable expenses incurred by record holders of J & J common stock, no par value (“Common Stock”),Stock, who are brokers, dealers, banks or voting trustees, or their nominees, for mailing proxy material and annual shareholder reports to the beneficial owners of Common Stock they hold of record, upon request of such recordholders.

What constitutes a quorum?

How many votes are needed to electThe holders of a director?

majority of the aggregate outstanding shares of Common Stock, present either in person or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting and at any postponement or adjournment of the Annual Meeting. Pursuant to the New Jersey Business CorporationCorporations Act (the “NJBCA”)(NJBCA), abstentions and broker non-votes (described below) will be counted for the purpose of determining whether a quorum is present.

What vote is required to approve each proposal?

| Proposal 1: | Election of Directors |

Pursuant to the NJBCA, the election of directors will be determined by a plurality vote and the one (1) nomineetwo (2) nominees receiving the most “FOR” votes will be elected. If any nominee for director in an uncontested election receives a greater number of votes “withheld” than votes “for” such election, our Director Resignation Policy requires that such nominee must promptly tender his or her resignation to the Board following certification of the vote, which the Board shall accept or reject within 90 days of the shareholder vote.

| Proposal 2: | Approval of the Company’s 2022 Long-Term Incentive Plan |

The affirmative vote of a majority of the votes cast on the proposal is required to approve the Company’s 2022 Long-Term Incentive Plan.

| 4 |

| Proposal 3: | Ratification of the Appointment of Independent Registered Public Accounting Firm |

The affirmative vote of a majority of the votes cast on the proposal is required to ratify the selection of our independent registered public accounting firm.

| Proposal 4: | Advisory Vote Approving Executive Compensation |

The affirmative vote of a majority of the votes cast on the proposal is required approve, on an advisory basis, the executive compensation described in this proxy statement.

| Proposal 5: | Advisory Vote Regarding the Frequency of Future Advisory Votes on Compensation |

The option of one year, two years or three years that receives the highest number of votes cast by shareholders will be considered the frequency for the advisory vote on executive compensation that is preferred by our shareholders.

Approval of any other proposal will require the affirmative vote of a majority of the votes cast on the proposal.

What constitutes a quorum?

The holders of a majority of the aggregate outstanding shares of Common Stock, present either in person or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting and at any postponement or adjournment of the Annual Meeting. Pursuant to the NJBCA, abstentions and broker non-votes (described below) will be counted for the purpose of determining whether a quorum is present.

What is the effect of abstentions and broker non-votes?

Under the NJBCA, abstentions, or a withholding of authority, or broker non-votes, are not counted as votes cast and, therefore, will have no effect on any proposal at the Annual Meeting. Brokers who hold shares for the accounts of their clients may vote such shares either as directed by their clients or in their own discretion if permitted by the applicable stock exchange or other organization of which they are members. Members of the New York Stock Exchange (“NYSE”) are permitted to vote their clients’ shares in their own discretion as to certain “routine” matters if the clients have not timely furnished voting instructions prior to the Annual Meeting. The election of directors, isthe approval of the Company’s 2022 Long-Term Incentive Plan, the advisory vote regarding executive compensation and the advisory vote regarding the frequency of future advisory votes on executive compensation are not considered a routine matter.matters and, consequently, without your voting instructions, your brokerage firm cannot vote your shares on these proposals. When a broker votes a client’s shares on some, but not all, of the proposals at a meeting, the omitted votes are referred to as “broker non-votes.”

How do I vote my shares?

If you are a registered shareholder (that is, if your stock is registered in your name), you may attendRegistered Shareholders can vote via the virtualInternet during the Annual Meeting and vote onlinewebcast or by proxy. There are three ways to vote by proxy. To vote by mail - mark, signproxy:

| ● | By Telephone – You can vote by calling 1-800-690-6903; | |

| ● | By Internet – You can vote over the Internet at www.proxyvote.com and following the instructions on the proxy card; or | |

| ● | By Mail – You can vote by completing, dating, signing and returning the enclosed proxy card. Please allow sufficient time for delivery of your proxy card if you decide to vote by mail. |

Telephone and date your proxy cardInternet voting facilities for shareholders of record will be available 24 hours a day and return such card in the postage-paid envelope J & J has provided you.

will close at 11:59 P.M. Eastern Time on February 13, 2023.

If you hold your shares in street name (that is, if you hold your shares through a broker, bank or other holder of record), you will receive a voting instruction form from your broker, bank or other holder of record. This form will explain which voting options are available to you. Please see the information provided on page 4 under the heading, AttendanceIf you want to vote in person at the Annual Meeting, ifannual meeting, you wishmust obtain an additional proxy card from your broker, bank or other holder of record authorizing you to vote at or duringvote. You must have this information available to access the meeting.

J & J encourages you to vote your shares for matters to be covered at the Annual Meeting.

| 5 |

What if I do not specify how I want my shares voted?

If you submit a signed proxy card but do not indicate how you want your shares voted, the persons named in the enclosed proxy will vote your shares of Common Stock:

● | “for” the election of each of Sidney R. Brown and Roy C. Jackson to serve as directors, each for a term ending at the |

● |

|

| “for” approval of the J & J Snack Foods Corp. |

● | “for” ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2023; | |

| ● | “for” the advisory vote approving executive compensation; and | |

| ● | “One Year” on the advisory vote regarding the frequency of future advisory votes on executive compensation; and | |

| ● | with respect to any other matter that properly comes before the Annual Meeting, the proxy holders will vote the proxies in their discretion in accordance with their best judgment and in the manner they believe to be in the best interest of |

Can I change my vote after submitting my proxy?

proxy?

Yes. You can change your vote at any time before your proxy is voted at the Annual Meeting. If you are a shareholder of record, you may revoke your proxy by:

● | submitting a later vote by telephone or the Internet; | |

| ● | submitting a later-dated proxy by mail; or |

● | attending the Annual Meeting via the webcast and voting electronically on the virtual meeting platform. Your attendance alone will not revoke your proxy. You must also vote electronically at the Annual Meeting. |

If you hold your shares in street name, you must contact your broker, bank or other nominee regarding how to change your vote.

Can shareholders speak or ask questions at the Annual Meeting?

Yes. J & J encouragesWe encourage shareholders to ask questions or to voice their views. J & JWe also wisheswish to assure order and efficiency for all attending shareholders. Accordingly, the Chairman of the Annual Meeting will have sole authority to make any determinations on the conduct of the Annual Meeting, including time allotted for each shareholder inquiry or similar rules to maintain order. Such determination by the Chairman of the Annual Meeting will be final, conclusive and binding. Anyone who is disruptive or refuses to comply with such rules of order will be excused from the Annual Meeting.

Who will tabulate the votes?

AttendanceVotes cast by proxy or in person will be counted by Broadridge Financial Solutions, Inc. who was appointed by us to act as election inspectors for the meeting.

Where do I find the voting results of the meeting?

We will announce the preliminary voting results at the Annual Meetingmeeting and provide the final results in a Current Report on Form 8-K filed with the SEC within four business days following the meeting.

| 6 |

Householding

We are permitted by the SEC to send a single copy of our Notice of Internet Availability and, if you requested printed versions by mail, the set of our proxy statement and annual report to stockholders who share the same last name and address. This procedure is called “householding” and is intended to reduce our printing and postage costs. We will promptly deliver a separate copy of our Notice of Internet Availability and, if you requested printed versions by mail, our annual report and proxy statement to you if you contact us at Attn: Michael A. Pollner, Corporate Secretary, J & J Snack Foods Corp., 350 Fellowship Road, Mount Laurel, NJ 08054; telephone us at (856) 665-9533; or email us at InvestorRelations@jjsnack.com. In addition, if you want to receive separate copies of the proxy statement or annual report in the future; if you and another shareholder sharing an address are receiving more than one copy of the proxy materials and would like to request delivery of a single copy of the proxy statement or annual report at such address in the future; or if you would like to make a permanent election to receive either printed or electronic copies of the proxy materials and annual report in the future, you may contact us at the same address, telephone number or email address. If you hold your shares through a broker or other intermediary and would like additional copies of our proxy statement or annual report or would like to request householding, please contact your broker or other intermediary.

| 7 |

CORPORATE SOCIAL RESPONSIBILITY

DueJ & J Snack Foods Corp. and its subsidiaries believe that every great snack starts with great products. This means committing to the publiclong-term health of people and the planet. J & J acknowledges that its activities have an impact on the environment both locally and globally. We recognize that the long-term success of our business is predicated on creating a cleaner and healthier environment, safeguarding and responsibly using natural resources, and reducing the impact of our operations while eliminating waste. We believe that a thoughtful approach to environmental, social and governance (ESG) matters is critical to our ongoing success and is the COVID-19 pandemicright thing to do.

J & J prioritizes the issues that fundamentally impact the company’s business and its stakeholders – focusing efforts and resources where they will have the greatest impact not just on our bottom line but on the communities we serve. During Fiscal Year 2022, J & J launched a series of initiatives designed to simultaneously drive growth, foster social prosperity, and encourage environmental stewardship. We recognize the importance of transparency as we commit to reducing energy usage and waste across all operations. To foster employee awareness and engagement, we established a sustainability advisory committee, charged with steering company efforts toward responsible environmental and social stewardship.

Thus far, we have installed flow regulators to reduce water usage at our facilities, converted fluorescent lighting to LEDs, adopted food scrap and oil reuse programs, and redesigned our packing materials to utilize less plastics. Looking beyond 2022, we are committed to driving environmental excellence in our operations by maintaining an effective environmental management system to measure, report, and audit our performance and establish a continuous improvement culture. This includes increasing communication and transparency with our consumers, so they have another reason to trust and enjoy our products.

Throughout our history, we have consistently demonstrated an outstanding enthusiasm of caring for each other, our customers, and the communities where we live and work. Over the past year, J & J renewed this long-standing commitment by: continuing our support of local outreach efforts like the ICEE Hope campaign, where we helped raise money to support the healthLeukemia and well-being ofLymphoma Society; “Clean the Creek” initiatives; back to school and holiday support drives, sponsoring employee safety and food safety initiatives; and organizing wellness seminars for our employeesemployees. Caring for our communities also means operating responsibly, ethically overseeing our supply chain and shareholders, we are pleasedensuring data security and customer and employee privacy. To that end, J & J has established a corporate governance structure and guidelines to provide shareholders with the opportunitystrengthen accountability across our business operations, reflecting our values and enabling us to participateachieve success in the Annual Meeting online via the Internet in a virtual-only meeting format to facilitate shareholder attendance and provide a consistent experience to all shareholders regardless of location. We will provide a live webcast of the Annual Meeting at www.virtualshareholdermeeting.com/JJSF2021, where you will also be able to submit questions and vote online. You will need your 16-digit control number included on your proxy card or in the instructions that accompanied your proxy materials. You will not be able to attend the meeting at a physical location.right way.

CORPORATE GOVERNANCE PRACTICES

If your shares are registered in street name, your method of voting is described above.

Methods of Voting

Shareholders can vote via the Internet during the Annual Meeting webcast or by proxy. There are three ways to vote by proxy:

| Size of the Board of Directors | 8 | |

| Number of Independent Directors | 5 | |

| Audit, Compensation and Governance Committees Consist Entirely of Independent Directors | Yes | |

| Annual Advisory Approval of Named Executive Officer Compensation | Yes | |

| All Directors Attended at Least 75% of Meetings Held | Yes | |

| Corporate Governance Guidelines | Yes | |

| Stock Ownership Guidelines for Directors | Yes | |

| Clawback Policy | Yes | |

| Stockholder Rights Plan (Poison Pill) | No |

|

|

| Table of Contents |

|

|

|

|

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. eastern time on February 9, 2021.

ELECTION OF DIRECTORS

INFORMATION CONCERNING NOMINEE FOR ELECTION TO BOARDOur Board of Directors currently consists of eight (8) members: Our chairman, Gerald B. Shreiber, whose term expires at our 2025 Annual Meeting; Sidney R. Brown and Roy C. Jackson, whose terms expire at our 2023 Annual Meeting; Mary Meder and Vincent Melchiorre, whose terms expire at our 2024 Annual Meeting; Peter Stanley, whose term expires at our 2026 Annual Meeting; and Marjorie S. Roshkoff and Dan Fachner, whose terms expire at our 2027 Annual Meeting.

One (1) director is expectedIn December 2022, our Board of Directors voted to be elected at the Annual Meetingnominate Sidney R. Brown and Roy C. Jackson for re-election to serve on the Board of Directors for a term ending at the 2028 Annual Meeting of J & J until the expiration of his term as indicated below and until his successor is elected and has qualified.

The following table sets forth information concerning J & J’s nominee for election to the Board of Directors.Shareholders. If the nomineeeither Mr. Brown or Mr. Jackson becomes unable or for good cause will not serve, the persons named in the enclosed form of proxy will vote in accordance with their best judgment for the election of such substitute nominee as shall be designated by the Board of Directors. The Board of Directors of J & J expects the nomineenominees to be willing and able to serve.

| Name | Age | Position | Year of Expiration of Term as Director |

| Peter G. Stanley | 78 | Director | 2026 |

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES.

Peter G. StanleyBiographical Information about the Nominees and Directors became

Set forth below are the names of the persons nominated as a director and directors whose terms do not expire this year, their ages as of December 15, 2022, their offices within the company, if any, their principal occupations or employment for the past five years, the length of their tenure as directors, the names of other public companies in 1983. Since November 1999 he has beenwhich such persons hold directorships or held directorships within the Chairman ofpast five years, and the particular experience, qualifications attributes or skills that led the Board of Emerging Growth Equities, Ltd., an investment banking firm. Mr. Stanley brings to determine that the Board experienceindividual should serve as a commercial and investment banker, with knowledge of strategic acquisitions and corporate finance. He provides the Board with strong financial skills and chairs our Audit Committee.director.

| Name | Age | Position | Year of Expiration of Term | ||||

| Gerald B. Shreiber | 81 | Chairman of the Board | 2025 | ||||

| Sidney R. Brown | 65 | Director | 2023 | ||||

| Dan Fachner | 62 | Director, President and CEO, J & J Snack Foods Corp. | 2027 | ||||

| Roy C. Jackson | 62 | Director | 2023 | ||||

| Mary Meder | 60 | Director | 2024 | ||||

| Vincent Melchiorre | 62 | Director | 2024 | ||||

| Marjorie S. Roshkoff | 54 | Director | 2027 | ||||

| Peter Stanley | 80 | Director | 2026 |

| 9 |

Gerald B. Shreiber Director since 1971 Age 81 Board Chairperson Committees: |  | Professional Experience: Mr. Shreiber is the founder of the Company and serves as the Chairman of the Board. Mr. Shreiber previously served as the Company’s Chief Executive Officer from its inception in 1971 until 2021. Mr. Shreiber is the father of Marjorie S. Roshkoff, who also is on the Board. Director Skills and Qualifications: ● Industry Experience ● Company History ● Management Experience | |

Sidney R. Brown Director since 2003 Age 65 Committees: |  | Professional Experience: Mr. Brown is the Chief Executive Officer of NFI Industries, Inc., a global integrated supply chain solutions provider. Mr. Brown is also on the Board of FS Investments Energy and Power Fund, a specialty finance company that invests primarily in income-oriented securities of private energy-related companies. In addition, he is a member of the Board of Trustees of Cooper Health Systems, a non-profit provider of health services in Southern New Jersey. Mr. Brown has management experience in running a large company and experience in executing strategic acquisitions. He has broad and vast experience in freight transportation and supply chain solutions. He also has a strong background in sales, marketing and finance. He became a director of the Company in 2003. Director Skills and Qualifications: ● Management Experience ● Finance ● Mergers and Acquisitions ● Transportation/Logistics | |

| 10 |

Roy C. Jackson Director since May 2022 Age 62 Committees: |  | Professional Experience: Roy C. Jackson has spent nearly 25 years in the Foodservice Industry. He has held senior level positions with PepsiCo, YUM! Brands and The Coca-Cola Company, where he retired in 2018 as Senior Vice President, Business Development & Industry Affairs. Mr. Jackson most recently held the position of Executive Vice President, Development & Industry Relations at the National Restaurant Association, of which the Company is an active member. Mr. Jackson’s experience has encompassed areas of increasing responsibility in sales, general management and restaurant operations. He currently serves as a board member of CustomerX.i Inc. and has held previous board roles with the Multi-Cultural Foodservice Hospitality Alliance, International Franchise Association and The National Restaurant Educational Foundation. Mr. Jackson received the Chairman’s Award of the National Restaurant Association in 2017 and the Partnership Award for the Women’s Foodservice Forum in 2017. Director Skills and Qualifications: ● Industry Experience ● Sales and Marketing ● Management Experience | |

Dan Fachner Director since May 2022 Age 62 Committees: |  | Professional Experience: Dan Fachner has been President and Chief Executive Officer of J & J Snack Foods Corp. since May 2021 and became a member of its Board of Directors in May 2022. Mr. Fachner began his career with the ICEE Company more than forty years ago and has held several roles with increasing responsibilities during that time, including President and CEO. During his tenure at The ICEE Company, he supported the organization’s growth in the United States, Mexico, Canada, Asia, Europe, Australia, Central America and the Middle East. Mr. Fachner is currently a member of the Board of Directors of Consumer Brands Association and In His Grip Golf. Mr. Fachner has also previously served on the Boards of Azusa Pacific University and Los Angeles Pacific University. Director Skills and Qualifications ● CEO Experience ● Industry Experience | |

| 11 |

Mary Meder Director since Age 60 Committees: |  | Professional Experience: Mary Meder currently serves as President at Harmelin Media, a national independently-owned strategic media and marketing agency located in Bala Cynwyd, PA. During her tenure as President, she has led agency growth from 85 employees to over 300, with annual billings approaching one billion dollars. Ms. Meder led the agency’s transformation, launching new services and platforms including digital media, performance marketing, influencer marketing, ecommerce, sports marketing, analytics and business intelligence. She brings over 35 years of business and advertising experience with her, with significant board experience through her long-term involvement with nonprofit organizations including Special Olympics of Pennsylvania (SOPA), Philadelphia Ad Club, and Penn State’s School of Communications. In 2011, Meder received the Special Olympics Pennsylvania Hall of Fame Al Senavitis Lifetime Achievement Award; she was honored in 2012 by the Cradle of Liberty Council – BSA – Good Scout Award; and she was recognized in 2014 by the Epilepsy Foundation and as a Mover & Shaker for the Philly Ad Club. Director Skills and Qualifications: ● Sales and Marketing ● Digital Media ● Management Experience | |

Vincent Melchiorre Director since 2013 Age 62 Committees: |  | Professional Experience: Mr. Melchiorre has approximately 40 years experience in the food industry. Mr. Melchiorre was Senior Vice President of Bimbo Bakeries USA, a position he held from September 2010 until his retirement in December 2022. From June 2007 to August 2010, Mr. Melchiorre was employed by J & J Snack Foods Corp. as Senior Vice President – Food Group. From May 2006 to June 2007, he was Senior Vice President, Bread and Roll business, George Weston Foods. From January 2003 to April 2006, he was Senior Vice President, Sales and Marketing at Tasty Baking Company and from June 1982 to December 2002 he was employed by Campbell Soup Company in various capacities, most recently as Vice President of Marketing of Pepperidge Farm. These experiences provide Mr. Melchiorre with an extensive knowledge of the food business including relevant experience in the fresh, frozen and shelf stable segments. In addition, he has had leadership roles in finance, information technology, operations, sales and marketing. Director Skills and Qualifications: ● Industry Experience ● Sales and Marketing ● Management Experience | |

| 12 |

Marjorie S. Roshkoff Director since 2020 Age 54 Committees: |  | Professional Experience: Ms. Roshkoff served as Vice President and General Counsel of J & J from 2019 until 2022. Prior to the General Counsel role, Ms. Roshkoff was a Vice President and in-house counsel for the Company and also managed the Human Resources function. Ms. Roshkoff has more than 20 years of legal experience and extensive knowledge of the Company’s history, organization and culture. She also adds the perspective of a long-term highly committed director and shareholder. Ms. Roshkoff is a daughter of Gerald B. Shreiber, the founder of the Company and current Chairman of the Board. Director Skills and Qualifications: ● Legal and Regulatory Experience ● Industry Experience ● Company Culture and History | |

Peter Stanley Director since 1983 Age 80 Committees: |  | Professional Experience: Since November 1999, Mr. Stanley has been the Chairman of the Board of Emerging Growth Equities, Ltd., an investment banking firm. Mr. Stanley brings to the Board experience as a commercial and investment banker, with knowledge of strategic acquisitions and corporate finance. He provides the Board with strong financial skills and chairs our Audit Committee. Mr. Stanley has developed a thorough understanding of the Company’s industry and history on account of his long service on our Board. Director Skills and Qualifications: ● Finance ● Mergers and Acquisitions ● Company History |

| 13 |

The Board recommends that you vote “FOR” the election of the nominee.

INFORMATION CONCERNING CONTINUING

DIRECTORS AND NAMED EXECUTIVE OFFICERS

| Name | Age | Position | Year of Expiration of Term as Director |

| Gerald B. Shreiber | 79 | Chairman of the Board, CEO | 2025 |

| Sidney R. Brown | 62 | Director | 2023 |

| Vincent Melchiorre | 60 | Director | 2024 |

| Marjorie S. Roshkoff, Esquire | 52 | Director, Vice -President, In-House Counsel, and Secretary | 2022 |

| Daniel Fachner | 60 | President | |

| Ken A. Plunk | 57 | Senior Vice President, Chief Financial Officer | |

| Robert M. Radano | 71 | Senior Vice President, Chief Operating Officer | |

| Robert Pape | 63 | Senior Vice President, Sales | |

| Dennis G. Moore | 65 | Senior Vice President, former Chief Financial Officer and former Director |

Gerald B. Shreiber is the founderCode of the Company and has served as its Chairman of the Board, President, and Chief Executive Officer since its inception in 1971. In addition to his leadership skills as Chief Executive Officer, Mr. Shreiber has a broad range of experience in production, marketing and finance. Also, he has a deep understanding of J & J’s business and its industry. In May 2020 Mr. Shreiber stepped down as President of J & J Snack Foods Corp.

Sidney R. BrownEthics is the Chief Executive Officer of NFI Industries, Inc., a premier integrated supply chain solutions provider. Mr. Brown is also on the Board of FS Energy and Power Fund, a specialty finance company that invests primarily in income-oriented securities of private energy-related companies. In addition, he is a member of the Board of Trustees of Cooper Health Systems, a non-profit provider of health services in Southern New Jersey. Mr. Brown has management experience in running a private company and experience in executing strategic acquisitions. He has broad experience in freight transportation. He also has a strong background in sales, marketing and finance. He became a director of the Company in 2003.

Vincent Melchiorre is Senior Vice President of Bimbo Bakeries USA since September 2010. From June 2007 to August 2010, Mr. Melchiorre was employed by J & J Snack Foods Corp. as Senior Vice President – Food Group. From May 2006 to June 2007 he was Senior Vice President, Bread and Roll business, George Weston Foods; from January 2003 to April 2006 he was Senior Vice President, Sales and Marketing at Tasty Baking Company and from June 1982 to December 2002 he was employed by Campbell Soup Company in various capacities, most recently as Vice President of Marketing of Pepperidge Farm. These experiences provide Mr. Melchiorre with an extensive knowledge of the food business including relevant experience in the fresh, frozen and shelf stable segments. In addition, he has had leadership roles in finance, information technology, operations, sales and marketing. Mr. Melchiorre became a director in August 2013.

Marjorie S. Roshkoffjoined the Company in February 2016 with more than 15 years of legal experience. In February 2017 she was appointed Vice President, In-House Counsel and Corporate Secretary. In this role, she oversees outside counsel and is responsible for the Company’s legal issues. Ms. Roshkoff became a director of the Company in 2020. In addition to her legal and employment related expertise, she has extensive knowledge of the Company’s history, organization and culture and adds the perspective of a long-term highly committed director, shareholder and employee regarding Board decisions and matters. Ms. Roshkoff is a daughter of Gerald B. Shreiber.

Daniel Fachner has been an employee of The ICEE Company since 1979 and became its President in August 1997. In May 2020 Mr. Fachner was named President of J & J Snack Foods Corp.

Ken A. Plunk was appointed Senior Vice President, Chief Financial Officer onSeptember 21, 2020. Prior to joining J & J, Mr. Plunk spent 12 years at Walmart Inc. most recently as Senior Vice President of International Finance. Prior to Walmart, he worked at The Home Depot for four years, holding leadership positions in merchandise finance and internal audit.

Robert M. Radano joined the Company in 1972 and in May 1996 was named Chief Operating Officer of the Company.

Robert Pape joined the Company in March 1998 as Senior Vice President of Sales and Marketing. Prior to joining the Company Mr. Pape worked for Campbell Soup Company as its National Sales Director.

Dennis G. Moore was Chief Financial Officer from 1992 until September 2020 when his successor was appointed. Mr. Moore was elected to the Board of Directors in 1995.

CORPORATE GOVERNANCE

Corporate Governance Guidelines

J & J is a Company incorporated under the laws of the State of New Jersey. In accordance with New Jersey law and J & J’s By-laws,Bylaws, the Board of Directors has responsibility for overseeing the conduct of J & J’s business. J & J has established a Code of Business Conduct and Ethics which is applicable to all directors, officers and employees of the Company. In addition, the Company has adopted a Code of Ethics for Chief Executive and Senior Financial Officers. Copies of these codes are available on the Company’s website.website at www.jjsnack.com.

The rules of NASDAQ require that a majority of the Company’s Board of Directors and the Membersmembers of the Audit Committee, Compensation Committee and the Nominating/ Governance Committee meet its independence criteria. No director qualifies as independent unless the Board determines that the director has no direct or indirect material relationship with the Company. The Board considers all relevant facts and circumstances of which it is aware in making an independence determination.

Based on the NASDAQ guidelines, the Board of Directors has determined that each of the following directors is independent: Sidney R. Brown, Roy C. Jackson, Mary Meder, Vincent Melchiorre and Peter G. Stanley. Neither Mr.Messrs. Jackson, Melchiorre and Stanley nor Mr. Melchiorre hasand Ms. Meder do not have a business, financial, family or other type of relationship with J & J. With respect to Mr. Brown’sBrown, his company, NFI Industries, provided transportation and supply chain solutions services to the Company totaling $180,000 in fiscal 2018, $540,000 in 2019 and $274,980 in fiscal 2020.year 2020, $633,056 in fiscal year 2021 and $662,565 in fiscal year 2022. The Board of Directors determined that Mr. Brown is independent irrespective of the services provided due to the relative levels of revenue of J & J and NFI Industries.

Certificate of Incorporation – Voting Provisions

As described in our Annual Report on Form 10-K, the Company’s Amended and Restated Certificate of Incorporation (the “Charter”) includes certain provisions relating to shareholder and director voting. Under the Charter, no shareholder may vote more than ten percent (10%) of the Company’s voting securities (the “Voting Threshold”), including the Company’s common stock, without approval from our Board of Directors, excluding those shareholders (such as

Mr. Shreiber) who held shares of common stock in excess of the Voting Threshold as of the date of the Charter’s adoption in 1990. The Charter grants the Company the right to repurchase shares held in excess of the Voting Threshold upon a duly adopted resolution of the Board of Directors.

Generally, each director of the Company’s Board of Directors is entitled to one vote on all matters upon which the Board of Directors is entitled to vote, except that Mr. Shreiber is granted certain special voting rights with respect to any matters to be voted upon by the Board of Directors. As a result, as of the date of this Proxy Statement, Mr. Shreiber is entitled to cast six (6) votes on all matters upon which the Board of Directors is entitled to vote. Further, in the event of a “hostile change of Board control,” which would occur only when one-half or more of the total number of directors serving on the Board of Directors have not been nominated by the Board of Directors or by a duly-authorized committee of the Board of Directors, our Charter grants “Experienced Directors,” defined as those Directors with more than five years of experience of serving as Directors of the Company, certain expanded voting rights that could delay, deter or prevent an acquisition of the Company.

| 14 |

We provide the following information about our directors for purposes of our compliance with NASDAQ rules. We ask our directors and director nominees to indicate their self-identification with respect to race/ethnicity, gender, gender identity, and sexual orientation, subject to applicable laws. Our Corporate Governance Guidelines place great emphasis on diversity and require that our Nominating and Corporate Governance Committee and full Board consider diversity as a factor in the recruitment and nomination of new directors.

Board Diversity Matrix (as of December 15, 2022)

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||

| Part I - Gender Diversity | ||||||||

| Directors | 2 | 6 | — | — | ||||

| Part II - Demographics Background | ||||||||

| African American or Black | — | 1 | — | — | ||||

| Alaskan Native or Native American | — | — | — | — | ||||

| Asian | — | — | — | — | ||||

| Hispanic or Latinx | — | — | — | — | ||||

| Middle Eastern | — | — | — | — | ||||

| Native Hawaiian or Pacific Island | — | — | — | — | ||||

| White | 2 | 5 | — | — | ||||

| Two or More Races or Ethnicities | — | — | — | — | ||||

| LGBTQ+ | — | — | — | — | ||||

| Did not disclose demographic background | — | — | — | — |

During the fiscal year, the Board of Directors held four (4) regularly scheduled meetings. Each Director attended at least 75% of the total meetings of the Board of Directors and the Committees on which he or she served.

Annual Meeting Attendance

It has been longstanding practice of the Company for all Directors to attend the Annual Meeting of Shareholders. All Directors then serving virtually attended the Annual Meeting held in February 2020.

2022.

Executive Sessions of Independent Directors

The Independent Directors meet in executive sessions without management present before or after regularly scheduled Board meetings. In addition, the Independent Directors meet at least once annually with the Chief Executive Officer at which time succession issues are discussed.

Director Stock Ownership Guidelines

The Board has established stock ownership guidelines for the non-employee directors. Within twothree years of election as a director, the director must attain and hold 30001,500 shares of J & J’sJ Common Stock. All current non-employee directors meet this guideline.guideline except for Mr. Jackson and Ms. Meder, who were appointed to Director in May 2022 and September 2022, respectively.

The Board of Directors has reviewed and discussed the leadership structure at the Company.Company and during fiscal 2021 determined that it would be in the best interests of the Company for the Board of Directors to separate the roles of

| 15 |

Chairman of the Board and President and Chief Executive Officer. As of the date of this proxy statement, the offices of Chairman and President and Chief Executive Officer are held by two separate individuals. Mr. Shreiber, currently serves as both principal executive officer and chairman of the Board. As the founder of the Company, serves as Chairman, and Mr. Shreiber has been its Chief Executive Officer and Chairman sinceFachner serves as the Company’s inception. He currently beneficially owns 19% of the Company’s stock and may be deemed to be its controlling shareholder. Over the years, it has been Mr. Shreiber’s position, shared by the full Board, that as controlling shareholder who is the founder of, and active in, the business, which Mr. Shreiber has been for over the last 48 years, he should hold both roles. During 2020 Mr. Shreiber, along with the remainder of the Board members, determined it was in the best interest of the Company and shareholders to appoint a president of the Company to manage the operations of the Company and move the strategic vision of the Company forward. Accordingly, on May 4, 2020, Daniel Fachner, President and Chief Executive Officer of the Company’s wholly owned subsidiary, The ICEE Company, was appointed President of the Company while continuing his role with The ICEE Company, positions he held since August 1997.Company.

In order to fulfill its responsibilities, the Board has delegated certain authority to its committees.Committees. There are three standing committees: (i) Audit Committee, (ii) Compensation Committee and (iii) Nominating/Nominating and Corporate Governance Committee. Each Committee has its own Charter which is reviewed annually by each committeeCommittee to assure ongoing compliance with applicable law and sound governance practices. Committee charters may be found on our website at www.jjsnack.com under the “Investors” tab and then under “Corporate Governance”. Paper copies are available at no cost by written request to Marjorie S. Roshkoff,Michael A. Pollner, Corporate Secretary, J & J Snack Foods Corp., 6000 Central Highway, Pennsauken, New Jersey 08109. Shareholders may also call 1-800-486-9533 or contact investorrelations@jjsnack.com for a paper copy.350 Fellowship Road, Mount Laurel, NJ 08054.

| Name | Audit Committee | Compensation Committee | Nominating Committee |

| Gerald B. Shreiber | |||

| Sidney R. Brown | Chair | X | |

| Dan Fachner | |||

| Roy C. Jackson | X | X | |

| Mary Meder | X | ||

| Vincent Melchiorre | X | Chair | |

| Marjorie S. Roshkoff | |||

| Peter G. Stanley | Chair | X |

The Audit Committee is comprised of directors Mr. Stanley (Chairman), Mr. BrownJackson and Mr. Melchiorre, each of whom qualifies as an independent director and meets the other requirements to serve on the Audit Committee under rules of the NASDAQ Stock Market. The principal functions of the Audit Committee include, but are not limited to, (i) the oversight of the accounting and financial reporting processes of the Company and its internal control over financial reporting; (ii) the oversight of the quality and integrity of the Company’s financial statements and the independent audit thereof; and (iii) the approval, prior to the engagement of, the Company’s independent auditors and, in connection therewith, to review and evaluate the qualifications, independence and performance of the Company’s independent auditors. The Audit Committee convened six (6) times during the 2020 fiscal year.to:

| ● | The oversight of the accounting and financial reporting processes of the Company and its internal control over financial reporting. | |

| ● | The oversight of the quality and integrity of the Company’s financial statements and the independent audit thereof. | |

| ● | Discussion of the audited financials with the Company’s management. | |

| ● | Recommend to the Company’s Board, as appropriate, that the Company’s audited financial statement be included in the Company’s annual report on Form 10-K. | |

| ● | The approval, prior to the engagement, of the Company’s independent auditors and, in connection therewith, to review and evaluate the qualifications, independence and performance of the Company’s independent auditors. |

The Audit Committee currently does not have an Audit Committee Financial Expert, as such term is defined in Section 407 of the Sarbanes-Oxley Act of 2002. The Audit Committee believes that the background and experience of its members allow them to perform their duties as members of the Audit Committee. This background and experience include a former banker and currentretired investment banker who regularly reviews financial statements of companies, a Chief Executive Officer of aretired executive with substantial private companyfinancial experience with financial oversight responsibilities who also is a former Chairman of the Board of a National Bank,sophisticated, global business operations, and a businessman who has had substantial financial oversight responsibilities with food companies.

The Audit Committee held seven (7) meetings during the 2022 fiscal year.

| 16 |

The Compensation Committee is comprised of directors Mr. Brown (Chairman), Mr. Jackson and Mr. Stanley, each of whom qualifies as an independent director under the rules of the NASDAQ Stock Market, and as non-employee directors under Rule 16b-3 of the Securities Exchange Act of 1934 and as outside directors under Section 162(m) of the Internal Revenue Service.(the “Exchange Act”). The Committee has responsibility for the following:

● | Annually review and determine the compensation of the |

● | Review and approve compensation paid to family members of officers and directors. |

● |

|

| Approve the form of employment contracts, severance arrangements, change in control provisions and other compensatory arrangements with officers. |

● | Approve cash incentives and deferred compensation plans for officers (including any modification to such plans) and oversee the performance objectives and funding for executive incentive plans. |

● | Approve compensation programs and grants involving the use of the Company’s stock and other equity |

● | Prepare an annual report on executive compensation for inclusion in the Company’s proxy statement for each annual meeting of shareholders in accordance with applicable rules and regulations. |

● |

|

| Have direct responsibility for the appointment, compensation and oversight of the work of any compensation consultant, legal counsel and other advisor retained by the Compensation Committee. |

● |

|

| Review the Committee’s performance annually. |

● | Review and reassess the adequacy of the Committee’s Charter annually and recommend to the Board any appropriate changes. |

● | Perform such other duties and responsibilities as may be assigned to the Committee, from time to time, by the Board. | |

| The Compensation Committee held three (3) meetings during the fiscal 2022 year. |

The Compensation Committee held three (3) meeting(s) during fiscal 2020.

The Nominating and Corporate Governance Committee is comprised of directors Mr. Melchiorre (Chairman), Mr. Brown and Mr. Stanley,Ms. Meder, each of whom qualifies as an independent director under rules of the NASDAQ Stock Market. This Committee’s primary responsibilities are to (1) maketo:

| ● | Make recommendations to the Board | |

| ● | Identify individuals qualified to become Board members and recommend to the Board qualified individuals to be nominated for election or appointment to the Board. | |

| ● | Conduct background and qualifications checks of persons it wishes to recommend to the Board as candidates or to fill vacancies. | |

| ● | Recommend to the Board the slate of nominees of directors to be proposed for election by the shareholders and individuals to be considered by the Board to fill vacancies. | |

| ● | Establish policies regarding the consideration of director candidates recommended by security holders. | |

| ● | Develop a succession plan for the Company’s Chief Executive Officer. | |

| ● | Develop corporate governance guidelines applicable to the Company. |

| 17 |

The Nominating and committees of the Board, (2) identify individuals qualified to become Board members and recommend to the Board qualified individuals to be nominated for election or appointed to the Board, (3) develop a succession plan for the Company’s Chief Executive Officer and (4) develop corporate governance guidelines applicable to the Company. TheCorporate Governance Committee will consider nominees for directors recommended by stockholders.shareholders. Any stockholdershareholder may recommend a prospective nominee for thesuch Committee’s consideration by submitting in writing to the Company’sMichael A. Pollner, Corporate Secretary, (at the Company’s address set forth below)J & J Snack Foods Corp., 350 Fellowship Road, Mount Laurel, NJ 08054, the prospective nominee’s name and qualifications.

The Nominating and Corporate Governance Committee held three (3) meetings during the fiscal 2020.2022 year.

Shareholder Proposals and Nominations

Any stockholdershareholder who wishes to submit a proposal to be voted on or to nominate a person for election to the Board of Directors at the Company’s annual meetingAnnual Meeting of stockholdersShareholders in 20222024 must notify the Company’s Secretary (at the Company’s address set forth above)(Michael A. Pollner, Corporate Secretary, J & J Snack Foods Corp., 350 Fellowship Road, Mount Laurel, NJ 08054), no earlier than August 23, 202129, 2023 and no later than September 22, 202128, 2023 (unless the date of the 20222024 annual meeting is more than 30 days before or more than 60 days after February 10, 2022,14, 2024, in which case the notice of proposal must be received (a) not more than 90 days prior to the annual anniversary of the date on which the Company first mailed proxy materials for the 20202023 annual meeting to shareholders, and (b) not earlier than the later of (i) 60 days prior to the annual anniversary of the date on which the Company first mailed proxy materials for the 20202023 annual meeting to shareholders, and (ii) the 10th10th day following the date on which the Company first publicly announces the date of the 20212024 annual meeting). The notice of a proposal or nomination must also include certain information about the proposal or nominee and about the stockholdershareholder submitting the proposal or nomination, as required by the Company’s By-Laws, and must also meet the requirements of applicable securities laws. In addition to satisfying the foregoing requirements under our bylaws, to comply with the universal proxy rules, shareholders who intend to solicit proxies in support of director nominees other than our nominees must provide notice to us that sets forth the information required by Rule 14a-19 under the Exchange Act no later than December 16, 2023.

To be considered for inclusion in the proxy statement for the 2024 annual meeting of shareholders pursuant to Rule 14a-8 of the Exchange Act, proposals must be received no later than September 5, 2023 and otherwise comply with the proxy rules. Proposals or nominations not meeting these requirements will not be presented at the annual meeting.

For more information regarding stockholdershareholder proposals or nominations, you may request a copy of the Bylaws from the Company’sMichael A. Pollner, Corporate Secretary, at the Company’s address set forth below.

J & J Snack Foods Corp., 350 Fellowship Road, Mount Laurel, NJ 08054.

Communication with The Board

Shareholders, employees and others may contact any of the Company’s Directors by writing to them c/o J & J Snack Foods Corp., 6000 Central Highway, Pennsauken, New Jersey 08109.350 Fellowship Road, Mount Laurel, NJ 08054, Attention: Corporate Secretary.

Compliance withDelinquent Section 16(a) of the Securities Exchange Act of 1934

16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934 requires that the Company’s directors and executive officers, and persons who beneficially own more than ten percent of the Company’s Common Stock, file with the Securities and Exchange Commission reports of ownership and changes in ownership of Common Stock and other equity securities of the Company. To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations received by it from such directors and executive officers, all Section 16(a) filing requirements applicable to the Company’s officers, directors and greater than ten-percentten percent (10%) beneficial owners were complied with during fiscal 2020.

2022, except that a Form 4 was not filed within two days of the partial vesting in October 2022 of a restricted share award originally granted to Ken Plunk in October 2020 and that Form 4 filings were not made on a timely basis following 2021 long-term equity grants to our executive officers in November 2021.

The Roleof the Board in Risk Oversight

The Board of Directors is responsible for oversight of the Company’s risk management process. The Board delegates to the Compensation Committee responsibility for oversight of management’s compensation risk assessment. The Board delegates other risk management oversight matters, including cyber security risks, to the Audit Committee. Our Audit Committee periodically discusses and evaluates risk with members of management, our independent auditors and our internal audit group. Both the Compensation Committee and Audit Committee report to the full Board where appropriate.

| 18 |

Risk Assessment – Incentive Compensation Programs

ItOur Compensation Committee conducted a risk assessment of our compensation programs and practices. This process included a review of our incentive compensation plans. Based on this process, our Compensation Committee concluded that our compensation programs and practices are appropriately structured and do not create risks that are reasonably likely to have a material adverse effect on the Company.

Policy on Claw Backs

The Company has a policy on the recovery of compensation under certain circumstances, which we refer to as “Claw Backs.” Under this policy a Claw Back review may be initiated as a result of any suspected non-compliance, which includes, but is not limited to:

| ● | fraud, money laundering, bribery, corruption or other form of misconduct; | |

| ● | any restatement of financial reports as a result of any misconduct; | |

| ● | any act causing reputational harm to the Company or its business activities; | |

| ● | any other grossly negligent acts or omissions of executives, including a failure to supervise in appropriate circumstances; | |

| ● | failure to identify, raise or assess in a timely manner any risks or concerns material to the Company, its business activities or its reputation; and | |

| ● | any other violation of the Company’s General Code of Ethics. |

Policy Against Hedging

The Board of Directors also unanimously adopted an Anti-Hedging Policy in 2020. Under this policy Executive Officers and Directors of the responsibilityCompany and its subsidiaries shall not, unless previously approved by the Nominating and Governance Committee of the Board, to understanddirectly or indirectly:

| ● | Purchase any financial instrument, or enter into any transaction, that is designed to hedge or offset a decrease in the market value of Company stock (including, but not limited to, prepaid variable forward contracts, equity swaps, collars or exchange funds); or | |

| ● | Hypothecate, or otherwise encumber shares of Company stock as collateral for indebtedness. This prohibition includes, but is not limited to, holding such shares in a margin account. |

Compensation Committee Interlocks and oversee the Company’s strategic plans, and the steps that senior management is taking to manage and mitigate those risks. In the normal courseInsider Participation

None of its business, the Company is exposed toour executive officers serves as a variety of risks, including marketing and sales, financial reporting and control, information technology, employee matters and legal issues. The identification and understandingmember of the risks are important in the successful managementcompensation committee of any other company that has an executive officer serving as a member of the Company. Key management is responsible for the day to day managementBoard. None of our executive officers serves as a member of the business risks.board of directors of any other company that has an executive officer serving as a member of our Compensation Committee.

| 19 |

Each non-employee directorOur Board of Directors has adopted the J & J Snack Goods Corp. Non-Employee Director Compensation Plan. Under this Plan, each Non-Employee Director then serving received on January 1, 2020 a paymentshall receive an annual fee of $91,000 (in Company stock or cash at the election of the director) as well as $750 per quarter as a retainer and $1,000 for attendance at each$150,000 payable within ten days of the Company’s four quarterly Board meetings.annual meeting. In addition, the Chairman of the Audit Committee receives an additional annual fee of $10,000.

In the event a Non-Employee Director serves for less than an entire year, the yearly portion of the annual fee payable for such year shall be prorated based on the number of days in the year for which the Director served. Under the Plan our Non-Employee Directors may elect to receive all or a portion of their annual fee in the form of shares of the Company’s common stock. The number of shares issuable pursuant to an election is equal to the value of the fee forgone divided by the fair market value of the Company’s common stock on the payment date. For 2022 all of our directors elected to receive their annual fee in the form of a cash payment.

2022 Director Compensation Table

The following table shows the director compensation paid for service on the Board during the fiscal year ending on September 24, 2022. Our Chairman, Mr. Shreiber, does not participate in the Non-Employee Director Compensation Plan nor does Mr. Fachner, our President and CEO. Mr. Fachner’s compensation is described in the “2022 Summary Compensation Table” below.

| Name | Fees Earned or Paid in Cash ($) | All Other Compensation | Total ($) | ||

| Gerald B. Shreiber | — | 13,616 | (1) | 13,616 | |

| Sidney R. Brown | 150,000 | — | 150,000 | ||

| Roy C. Jackson | 92,307 | (2) | — | 92,307 | |

| Mary Meder | 50,000 | (2) | — | 50,000 | |

| Vincent Melchiorre | 150,000 | — | 150,000 | ||

| Marjorie S. Roshkoff | 112,000 | (2) | 24,167 | (3) | 136,167 |

| Peter G. Stanley | 160,000 | — | 160,000 | ||

| (1) | Includes the value of certain health and welfare benefits provided to the Director. |

| (2) | Represents a pro-rata portion of the annual fee under the Non-Employee Director Compensation Plan paid to Ms. Roshkoff following the end of her employment by the Company as General Counsel and, in the case of Mr. Jackson and Ms. Meder, following their election to the Board in May 2022 and September 2022, respectively. |

| (3) | Includes COBRA premiums payable by the Company on Ms. Roshkoff’s behalf following her separation from the Company as General Counsel. |

| 20 |

The primary purpose of the Audit Committee is to oversee the Company’s accounting and financial reporting process and the audits of the Company’s financial statements.

The Company’s management is responsible for Fiscal 20the integrity of the Company’s financial statements, as well as its accounting and financial reporting process and internal controls for compliance with applicable accounting standards, laws and regulations. The Company’s independent registered public accounting firm, Grant Thornton LLP (“Grant Thornton”), is responsible for performing an independent audit of the Company’s financial statements in accordance with generally accepted auditing standards and expressing an opinion in its report on those financial statements.

The Audit Committee is responsible for monitoring and reviewing these processes, as well as the independence and performance of the Company’s independent registered public accounting firm. The Audit Committee does not conduct auditing or accounting reviews or procedures. The Audit Committee has relied on management’s representation that the financial statements have been prepared with integrity and in conformity with generally accepted accounting procedures in the U.S. and on the registered public accounting firm representations included in its report on the Company’s financial statements. The Company’s independent registered public accounting firm also audited and discussed with the Audit Committee the Company’s internal control over financial reporting.

The Audit Committee reviewed and discussed with management the Company’s audited financial statements for fiscal year 2022. The Audit Committee discussed with the Company’s registered public accounting firm, Grant Thornton, matters required to be discussed by the applicable standards of the Public Company Accounting Oversight Board.

The Audit Committee has received and reviewed the written disclosures and the letter from Grant Thornton required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accounting firm’s communications with the Audit Committee concerning independence. In addition, the Audit Committee discussed with Grant Thornton its independence from the Company and considered whether the providing of non-audit services to the Company by Grant Thornton is compatible with maintaining Grant Thornton’s independence.

Based on these reviews and discussions and in reliance thereon, the Audit Committee recommended to the Board of Directors that the audited financial statements for the Company be included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 24, 2022.

Audit Committee of the Board of Directors:

Peter G. Stanley, Chairman

Roy C. Jackson

Vincent Melchiorre

| 21 |

PROPOSAL 2

APPROVAL OF THE

J & J SNACK FOODS CORP.

2022 LONG-TERM INCENTIVE PLAN

We are asking for our shareholders to approve the J & J Snack Foods Corp. 2022 Long-Term Incentive Plan (the “2022 Plan”). The Board approved the 2022 Plan on November 9, 2022, subject to approval by our shareholders. The 2022 Plan is set forth in Exhibit A to this proxy statement and is incorporated by reference herein.

Overview of the Plan

The Board recommends that shareholders approve the 2022 Plan in order to attract, retain and compensate our employees, consultants and directors and align the interests of our shareholders with management.

The Company currently maintains the J & J Snack Foods Corp. Amended and Restated Stock Incentive Plan (the “Prior Plan”). As of December 24, 2022, the Prior Plan had approximately 46,363 shares available for issuance. In order to continue to provide a means to offer equity based incentive compensation to the Company’s employees, consultants and directors, the Board and Compensation Committee have determined it is in the best interests of the Company and its shareholders to adopt the 2022 Plan. If the 2022 Plan is approved by our shareholders, the 2022 Plan will replace the Prior Plan and no further grants will be made under the Prior Plan. Any awards previously granted under the Prior Plan will remain subject to the terms of the Prior Plan.

If our shareholders approve this Proposal 2, the 2022 Plan will become effective immediately. If the 2022 Plan is not approved by our shareholders, the Prior Plan will remain in place and we could continue to grant awards under the Prior Plan. However, if the 2022 Plan is not approved by our shareholders, we will not have a sufficient number of shares available for grant to our employees, consultants and directors to continue to provide meaningful equity-based incentive compensation going forward. Accordingly, the Board recommends the approval of the 2022 Plan.

The 2022 Plan Includes Features Designed to Protect Shareholder Interests

The 2022 Plan includes a number of provisions that we believe promote good compensation and governance practices. These provisions include, but are not limited to, the following:

| ● | No Liberal Share Recycling Provisions. Subject to customary exceptions, shares underlying the 2022 Plan will count against the 2022 Plan share reserve unless the award is forfeited, canceled or expires. The following shares may not again be made available for issuance as awards under the Plan: (a) shares covered by an award that are surrendered or withheld in payment of the award’s exercise or purchase price (including pursuant to the “net exercise” of an option), or in satisfaction of tax withholding obligations with respect to an award, and (b) shares of common stock repurchased on the open market with the proceeds of any option exercise price. Additionally, if a stock appreciation right (“SAR”) is exercised and shares are issued, the full number of shares underlying the SAR would count against the share reserve, not just the net number of shares issued upon exercise. | |

| ● | No Repricing of Options or SARs. The 2022 Plan does not permit repricing of options or SARs without prior shareholder approval. | |

| ● | Clawback Policies. To the extent allowed under applicable law, all awards under the 2022 Plan, and any related payments made thereunder, will generally be subject to the requirements of any applicable clawback, repayment or recapture policy implemented by the Company. | |

| ● | No Automatic Grants. The 2022 Plan does not provide for automatic grants to any participant. | |

| ● | No Dividend or Dividend Equivalents on Options or SARs. The 2022 Plan prohibits paying dividends or dividend equivalents on options and SARs. Dividends for restricted stock and dividend equivalents for awards other than options, SARs and restricted stock may be provided under the 2022 Plan, but any such dividends or dividend equivalents are subject to forfeiture and will only be paid out to the same extent as the underlying award vests or is otherwise earned. | |

| ● | No Tax Gross-Ups. The 2022 Plan does not provide for any tax gross-ups. |

| 22 |

| ● | No “liberal change in control” definition. A change in control transaction must actually be consummated in order for the change in control provisions in the 2022 Plan to be triggered. | |

| ● | Option Exercise Price and SAR base price. Options and SARs may not be granted with an exercise price or base price below the fair market value of a share on the grant date. |

Determination of the Number of Shares Reserved for Issuance under the 2022 Plan

The maximum number of shares that may be issued pursuant to all awards (including incentive stock options) is 400,000 shares, less the total number of shares covered by any awards granted under the Prior Plan after December 24, 2022. Additionally, each award granted under the Prior Plan that is outstanding as of the date the 2022 Plan is approved by the Company’s shareholders will be treated as an award for purposes of the 2022 Plan, such that shares covered by such award (or a portion of such award) will be added to the 2022 Plan’s authorized share limit if the award (or a portion of such award) is forfeited, canceled or expires (whether voluntarily or involuntarily) without the issuance of shares.

Shares issued in settlement or assumption of, or in substitution for, outstanding awards in connection with the Company acquiring another entity, an interest in another entity or similar, whether by merger, stock purchase, asset purchase or other form of transaction, will not count against the 2022 Plan share reserve. Additionally, available shares under a shareholder approved plan of an acquired company may be used for issuance of awards under the 2022 Plan without reducing the 2022 Plan share reserve, subject to applicable restrictions under the rules of the stock exchange on which the Company’s shares are listed.